UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

KONTOOR BRANDS, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies:

| |||

| 2) | Aggregate number of securities to which transaction applies:

| |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4) | Proposed maximum aggregate value of transaction:

| |||

| 5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid:

| |||

| 2) | Form, Schedule or Registration Statement No.:

| |||

| 3) | Filing Party:

| |||

| 4) | Date Filed:

| |||

KONTOORTM

2021 Notice of

Annual Meeting

of Shareholders

2021

and Proxy Statement

|

Letter to Shareholders |

March 9, 2021

Dear Shareholders:

On behalf of the Board of Directors and the leadership team, I am pleased to invite you to attend the Kontoor Brands, Inc. 2021 Annual Meeting of Shareholders (the “Annual Meeting”) on Tuesday, April 20, 2021, at 11:00 a.m., Eastern Time, to be held live via the Internet at www.proxydocs.com/KTB. The format of the Annual Meeting will be a virtual-only meeting, instead of an in-person meeting, due to continued public health precautions regarding in-person gatherings and to support the health and well-being of shareholders and company personnel given the COVID-19 pandemic. Shareholders will not be able to attend the Annual Meeting in person.

Attached to this letter are a Notice of Annual Meeting of Shareholders and a Proxy Statement, which describe the business to be conducted at the Annual Meeting. We also will report on matters of current interest to our shareholders.

In accordance with the Securities and Exchange Commission rules allowing companies to furnish proxy materials to their shareholders over the Internet, we have sent shareholders of record at the close of business on February 16, 2021 a Notice of Internet Availability of Proxy Materials (“Notice”) on or about March 9, 2021. The Notice contains instructions on how to access our Proxy Statement and Annual Report and vote online. If you would like to receive a printed copy of these proxy materials from us instead of downloading a printable version from the Internet, please follow the instructions for requesting such materials included in the Notice, as well as in the attached Proxy Statement.

We have designed the format of the Annual Meeting to ensure that shareholders are afforded the same rights and opportunities to participate as they would at an in-person meeting, using online tools to ensure shareholder access and participation. To attend the Annual Meeting, shareholders must register in advance, using their control number and other information, at www.proxydocs.com/KTB prior to the deadline of Friday, April 16, 2021, at 5:00 p.m., Eastern Time. Upon completing registration, shareholders will receive further instructions by e-mail, including links that will allow them to access the Annual Meeting, submit questions, and vote online during the Annual Meeting.

Beginning one hour prior to, and during, the Annual Meeting, support will be available to assist shareholders with any technical difficulties they may have accessing, hearing or participating in the virtual meeting. If participants encounter any difficulty accessing, or during, the virtual meeting, they should call the support team at the numbers listed on the e-mailed instructions.

Your vote is important to us. To ensure that you will be represented, we ask you to vote your shares on the Internet, by telephone or by mail as soon as possible, or you may vote during the live webcast of the Annual Meeting. Voting on the Internet, by telephone or by mail does not deprive you of your right to attend the Annual Meeting. If you do attend the Annual Meeting and wish to vote your shares personally, you may revoke your proxy at or prior to the Annual Meeting.

I thank you for your continued support of our company.

Sincerely,

Scott Baxter

President and Chief Executive Officer

|

Notice of Annual Meeting of Shareholders |

To Be Held April 20, 2021

March 9, 2021

To the Shareholders of Kontoor Brands, Inc.:

The 2021 Annual Meeting of Shareholders of Kontoor Brands, Inc. will be held live virtually via the Internet at www.proxydocs.com/KTB, on Tuesday, April 20, 2021, at 11:00 a.m., Eastern Time, for the following purposes:

| 1. | to elect two Class II directors for a term ending at the 2023 annual meeting of shareholders; |

| 2. | to ratify the appointment of PricewaterhouseCoopers LLP as Kontoor’s independent registered public accounting firm for the fiscal year ending January 1, 2022; |

| 3. | to approve the compensation of Kontoor’s named executive officers as disclosed in this Proxy Statement; and |

| 4. | to transact such other business as may properly come before the meeting and any adjournments thereof. |

A copy of Kontoor’s Annual Report for the fiscal year ended January 2, 2021 is included for your information.

Only shareholders of record as of the close of business on February 16, 2021 are entitled to notice of and to vote at the meeting.

To attend the Annual Meeting, shareholders must register in advance, using their control number and other information, at www.proxydocs.com/KTB prior to the deadline of Friday, April 16, 2021, at 5:00 p.m., Eastern Time. Upon completing registration, shareholders will receive further instructions by e-mail, including links that will allow them to access the Annual Meeting, submit questions, and vote online during the Annual Meeting. Shareholders will not be able to attend the Annual Meeting in person.

By Order of the Board of Directors

Laurel Krueger

Executive Vice President,

General Counsel and Corporate Secretary

YOUR VOTE IS IMPORTANT

You are urged to vote your shares in advance via the Internet, through our toll-free telephone number, or by signing, dating and promptly returning your completed proxy card.

| 2021 Notice of Annual Meeting of Shareholders |

|

Contents |

| Proxy Statement Summary | 1 | |||

| 1 | ||||

| 1 | ||||

| 1 | ||||

| 2 | ||||

| Voting Matters | 3 | |||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 6 | ||||

| Proposal No. 1—Election of Directors | 7 | |||

| Executive Officers | 13 | |||

| Corporate Governance | 14 | |||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| Talent and Compensation Committee Interlocks and Insider Participation |

19 | |||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| Director Compensation | 22 | |||

| 23 | ||||

| Executive Compensation | 24 | |||

| 24 | ||||

| 40 | ||||

| 41 | ||||

i

| ii |

|

|

Summary |

This summary highlights certain information about Kontoor Brands, Inc. (the “Company,” “Kontoor,” “we,” “us” or “our”) contained in this proxy statement (“Proxy Statement”), but does not contain all the information that you should consider when casting your vote. Please review this entire Proxy Statement as well as our Annual Report for the fiscal year ended January 2, 2021 (“Annual Report”) carefully before voting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD

ON APRIL 20, 2021

This Proxy Statement and our Annual Report are available at

www.proxydocs.com/KTB

The Board of Directors of the Company (the “Board”) is furnishing you this Proxy Statement to solicit proxies, on its behalf, to be voted at the Company’s 2021 Annual Meeting of Shareholders (the “Annual Meeting”) to be held on Tuesday, April 20, 2021, at 11:00 a.m., Eastern Time, via the Internet at www.proxydocs.com/KTB, and at any adjournments thereof. The format of the Annual Meeting will be a virtual-only meeting, instead of an in-person meeting, due to continued public health precautions regarding in-person gatherings and to support the health and well-being of shareholders and company personnel given the COVID-19 pandemic. Shareholders will not be able to attend the Annual Meeting in person.

The Board has made this Proxy Statement and our Annual Report available to you over the Internet at www.proxydocs.com/KTB or, upon your request, has mailed you a printed version of these proxy materials in connection with the Annual Meeting. We mailed the Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders, and this Proxy Statement and our Annual Report were posted to the above-referenced website, on or about March 9, 2021.

On May 22, 2019, VF Corporation (“VF”) completed the spin-off of its Jeanswear business, which included the Wrangler, Lee and Rock & Republic brands, as well as the VF Outlet business. The spin-off transaction (the “Spin-Off”) was effected through a pro-rata distribution to VF shareholders of one share of Kontoor common stock for every seven shares of VF common stock held on the record date of May 10, 2019. Kontoor began to trade as a standalone public company on the New York Stock Exchange (the “NYSE”) under the ticker symbol “KTB” on May 23, 2019.

Although Kontoor and VF have operated as separate companies since the Spin-Off, rules and regulations of the Securities and Exchange Commission (the “SEC”) and/or the NYSE require that we provide certain information (including compensation information) regarding our executive officers and directors for the period of time prior to the Spin-Off (including for service to VF). We have endeavored to clearly indicate for you throughout this Proxy Statement what information relates to Kontoor prior to the Spin-Off and where we have changed our approach.

| Time and Date: | 11:00 a.m., Eastern Time, Tuesday, April 20, 2021 | |

| Webcast Address: | Annual Meeting to be held live virtually via the Internet—please visit www.proxydocs.com/KTB for more details. | |

| Record Date: | February 16, 2021 | |

1

| Proxy Statement Summary |

| Proposal | Board Recommendation | Page Reference | ||

| Proposal No. 1: Election of two Class II Directors for a term ending at the 2023 annual meeting of shareholders |

The Board recommends a vote “FOR” each of the director nominees. | See “Proposal No. 1—Election of Directors” beginning on page 7 of this Proxy Statement. | ||

| Proposal No. 2: Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 1, 2022 |

The Board recommends a vote “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 1, 2022. | See “Proposal No. 2—Ratification of Appointment of Independent Registered Public Accounting Firm” beginning on page 57 of this Proxy Statement. | ||

| Proposal No. 3: Approval of the compensation of our named executive officers on a non-binding advisory basis (“Say-on-Pay vote”) |

The Board recommends a vote “FOR” the approval of the compensation of our named executive officers on a non-binding advisory basis. | See “Proposal No. 3—Approval of Named Executive Officer Compensation on a Non-Binding Advisory Basis (“Say-on-Pay Vote”)” beginning on page 59 of this Proxy Statement. | ||

| 2 |

|

|

|

If, at the close of business on February 16, 2021 (the “Record Date”), you held shares (a) directly in your name as a shareholder of record or (b) through a broker, bank or other nominee (shares held in “street name”), you have one vote for each such share of Kontoor common stock and may vote your shares by proxy via the Internet, by telephone or by mail, or you may vote your shares during the live webcast of the Annual Meeting. For shares held in street name, you generally cannot vote your shares directly and instead may vote by submitting voting instructions to your broker, bank or other nominee. Please refer to information from your broker, bank or other nominee on how to submit voting instructions. As of the close of business on the Record Date, approximately 57,390,649 shares were outstanding and entitled to vote.

The presence, on the live webcast of the Annual Meeting or by proxy, of the holders of a majority of the outstanding shares entitled to cast a vote on a particular matter to be acted upon at the Annual Meeting constitutes a quorum for the purposes of consideration and action on the matter. Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, as described below under “How Votes are Counted,” if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”).

We are asking you to vote on the following:

| • | Proposal No. 1: Election of two Class II directors for a term ending at the 2023 annual meeting of shareholders; |

| • | Proposal No. 2: Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 1, 2022; and |

| • | Proposal No. 3: Approval of the compensation of our named executive officers on a non-binding advisory basis (“Say-on-Pay vote”). |

For Proposal No. 1, you may vote “FOR” both director nominees or “WITHHOLD” your vote for either or both of the director nominees. Proposal No. 1 requires that each director is elected by the vote of the majority of the votes cast with respect to the director at a meeting at which a quorum is present. This means that the number of shares voted “FOR” a director must exceed the number of “WITHHOLD” votes with respect to that director. Abstentions and broker non-votes will have no effect on the election of directors.

For Proposal No. 2, you may vote “FOR” or “AGAINST” or abstain from voting. Proposal No. 2 requires the affirmative vote of the holders of a majority of the shares cast at a meeting at which a quorum is present. Abstentions will not be considered as votes cast and, as a result, will not have any effect on the proposal. Because the ratification of the appointment of the independent registered public accounting firm is considered a routine matter, there will be no broker non-votes with respect to Proposal No. 2, and a broker will be permitted to exercise its discretion to vote uninstructed shares on Proposal No. 2.

For Proposal No. 3, you may vote “FOR” or “AGAINST” or abstain from voting. Proposal No. 3 requires the affirmative vote of the holders of a majority of the shares cast at a meeting at which a quorum is present. Proposal No. 3 is advisory in nature and non-binding, and the Board will review the voting results and expects to take them into consideration when making future decisions regarding executive compensation. Abstentions and broker non-votes will not be considered as votes cast and, as a result, will not have any effect on Proposal No. 3.

3

| Voting Matters |

For shareholders of record, all shares represented by the proxies will be voted at the Annual Meeting in accordance with instructions given by the shareholders. Where a shareholder returns its proxy and no instructions are given with respect to a given matter, the shares will be voted: (1) “FOR” the election of the Board’s director nominees; (2) “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 1, 2022; (3) “FOR” the approval of the compensation of our named executive officers; and (4) as recommended by the Board or, if no recommendation is given, in the discretion of the proxy holders upon such other business as may properly come before the Annual Meeting. If you are a shareholder of record and you do not return your proxy, no votes will be cast on your behalf on any of the items of business at the Annual Meeting.

For beneficial owners of shares held in street name, the brokers, banks or other nominees holding shares for beneficial owners must vote those shares as instructed. Absent instructions from you, brokers, banks and other nominees may vote your shares only as they decide as to matters for which they have discretionary authority under the applicable NYSE rules. A broker, bank or other nominee does not have discretion to vote on the election of directors or approval of the compensation of our named executive officers. If you do not instruct your broker, bank or other nominee how to vote on those matters, no votes will be cast on your behalf on Proposal No. 1 or Proposal No. 3. Your broker will be entitled to vote your shares in its discretion, absent instructions from you, on Proposal No. 2.

Our Board recommends that you vote your shares:

| • | “FOR” each of the director nominees set forth in this Proxy Statement; |

| • | “FOR” the ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending January 1, 2022; and |

| • | “FOR” the approval of the compensation of our named executive officers. |

| 4 |

|

| Voting Matters |

If you are a shareholder of record or hold shares in street name and are voting by proxy, please refer to your proxy card or other information forwarded by your bank, broker or other nominee to see when your vote, or voting instructions if you hold shares in street name, must be received. All proxies must be received by Kontoor by 11:59 p.m., Eastern Time, on April 19, 2021 to be counted.

IF YOU ARE A SHAREHOLDER OF RECORD, YOU MAY VOTE BY GRANTING A PROXY. TO VOTE BY PROXY:

|

|

| ||

| By Internet

Go to the website www.proxypush.com/KTB and follow the instructions on how to complete an electronic proxy card, 24 hours a day, seven days a week. You will need the 12-digit number included on your Notice or proxy card to vote by Internet. |

By Telephone

From a touch-tone telephone, dial 866-390-5386 and follow the recorded instructions, 24 hours a day, seven days a week. You will need the 12-digit number included on your Notice or proxy card in order to vote by telephone. |

By Mail

Request a proxy card from us by following the instructions on your Notice. When you receive the proxy card, mark your selections on the proxy card. Date and sign your name exactly as it appears on your proxy card. Mail the proxy card in the enclosed postage-paid envelope provided to you, or return it to:

PROXY TABULATOR FOR Kontoor Brands, Inc. P.O. Box 8016 Cary, NC 27512-9903 | ||

If you hold your shares in street name, you may submit voting instructions to your broker, bank or other nominee. In most instances, you will be able to do this over the Internet, by telephone or by mail. Please refer to information from your bank, broker or other nominee on how to submit voting instructions.

If you receive more than one Notice, it generally means you hold shares registered in more than one account. To ensure that all your shares are voted, please sign and return each proxy card or, if you vote by Internet or telephone, vote once for each Notice you receive.

During the Annual Meeting

We have designed the format of the Annual Meeting to ensure that shareholders are afforded the same rights and opportunities to participate as they would at an in-person meeting, using online tools to ensure shareholder access and participation. To submit questions and vote during the live webcast of the Annual Meeting, you must first register at www.proxydocs.com/KTB, using your control number and other information, at www.proxydocs.com/KTB prior to the deadline of Friday, April 16, 2021, at 5:00 p.m. Eastern Time. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you to access the Annual Meeting and vote online during the meeting. Please be sure to follow instructions found on your proxy card or other information forwarded by your bank, broker or other nominee and subsequent instructions that will be delivered to you via email.

Beginning one hour prior to, and during, the Annual Meeting, support will be available to assist shareholders with any technical difficulties they may have accessing, hearing or participating in the virtual meeting. If participants encounter any difficulty accessing, or during, the virtual meeting, they should call the support team at the numbers listed on the e-mailed instructions.

Even if you plan to attend the Annual Meeting, we encourage you to vote in advance by Internet, telephone or mail so that your vote will be counted even if you later decide not to attend the Annual Meeting.

5

| Voting Matters |

How to Change Your Vote or Revoke Your Proxy

If you are a shareholder of record, you may change your vote or revoke your proxy by:

| • | sending a written statement to that effect to our Corporate Secretary, provided such statement is received no later than April 19, 2021; |

| • | voting again by Internet or telephone at a later time before the closing of those voting facilities at 11:59 p.m., Eastern Time, on April 19, 2021; |

| • | submitting a properly signed proxy card to: PROXY TABULATOR FOR Kontoor Brands, Inc., P.O. Box 8016, Cary, NC 27512-9903, with a later date that is received no later than April 19, 2021; or |

| • | registering prior to the deadline of Friday, April 16, 2021, at 5:00 p.m. Eastern Time, attending the Annual Meeting, revoking your proxy and voting during the live webcast of the Annual Meeting. |

If you hold shares in street name, you may submit new voting instructions by contacting your bank, broker or other nominee. You may also change your vote or revoke your proxy during the live webcast of the Annual Meeting if you obtain a signed proxy from the record holder (broker, bank or other nominee) giving you the right to vote the shares.

| 6 |

|

|

Election of Directors |

The seven individuals named below currently serve on our Board of Directors. Richard Carucci, a Class II director, will not be standing for re-election to the Board at the Annual Meeting. Kontoor acknowledges and thanks Mr. Carucci for his outstanding service on the Board. Following the conclusion of the Annual Meeting, the size of the Board will be decreased from seven directors to six directors.

| Name |

Principal Occupation | Audit Committee |

Talent and Compensation |

Nominating

and Governance Committee | ||||

| Robert Shearer Chair of the Board |

Retired; Former Senior Vice President and Chief Financial Officer, VF Corporation | Chair | ||||||

|

Scott Baxter |

President and Chief Executive Officer, Kontoor Brands, Inc. | |||||||

|

Kathleen Barclay |

Retired; Former Chief Human Resources Officer and Senior Vice President, Kroger Co. | Chair | Member | |||||

| Richard Carucci |

Retired; Former President, Yum! Brands, Inc. | Member | Member | |||||

| Juliana Chugg |

Retired; Former EVP, Chief Brands Officer, Mattel, Inc. | Member | Chair | |||||

| Robert Lynch |

President and Chief Executive Officer, Papa John’s International, Inc. | Member | Member | |||||

| Shelley Stewart, Jr. |

Retired; Former Chief Procurement Officer, E.I. du Pont de Nemours & Co. | Member | Member | |||||

| Number of Meetings Held in Fiscal 2020 |

Board—18 | 9 | 6 | 4 | ||||

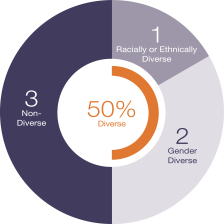

BOARD DIVERSITY

(following the Annual Meeting)

The directors are currently divided into three classes. There are currently two Class I directors, three Class II directors, and two Class III directors. At the Annual Meeting, you will be asked to elect two Class II directors: Ms. Barclay and Mr. Lynch. Both of the director nominees currently serve as Class II directors whose terms of office expire at the Annual Meeting and, if elected at the Annual Meeting, will serve for a term of office to expire at the annual meeting of shareholders to be held in 2023.

7

Proposal No. 1 – Election of Directors

The Class I and Class III directors will continue to serve on the Board. The term of the Class I directors will terminate at the annual meeting of shareholders to be held in 2023, and the term of the Class III directors will terminate at the annual meeting of shareholders to be held in 2022. Each Class III director to be elected at the 2022 annual meeting of shareholders will serve for a term of office to expire at the annual meeting of shareholders to be held in 2023. Beginning with the 2023 annual meeting of shareholders, directors will be elected for a one-year term expiring at the next annual meeting of shareholders, and the classification of the Board will cease. This temporary classified board structure is intended to provide better continuity of leadership during the Company’s first years of operation as an independent, publicly held business.

The following section provides information with respect to each director nominee and each other director of the Company who will continue to serve as a director after the Annual Meeting. It includes the specific experience, qualifications and skills considered by the Nominating and Governance Committee and/or the Board in assessing the appropriateness of the person to serve as a director. (Ages are presented as of March 9, 2021.)

Class II Nominees to Serve Until the 2023 Annual Meeting of Shareholders

Kathleen Barclay Former Chief Human Resources Officer and Senior Vice President, Kroger Co.

| Age: 65 | Committees: | Nominating and Governance Committee

| |

| Talent and Compensation Committee (Chair) |

Kathleen Barclay has served on the Board since the Spin-Off. She was previously Chief Human Resources Officer and Senior Vice President of The Kroger Co., a $110 billion grocery retail company, from 2010 until her retirement in late 2015. Prior to joining The Kroger Co., Ms. Barclay served in several leadership roles at General Motors Corporation, including Senior Vice President of Global Human Resources. She currently serves as a member of the board of directors of Five Below, Inc.

Ms. Barclay earned a bachelor’s degree in Business from Michigan State University and a Master of Business Administration from the Massachusetts Institute of Technology. She is a three-time recipient of Automotive News’ 100 Leading Women, a recipient of the MSU Distinguished Alumni award, and has been named to Human Resource Executive magazine’s HR Honor Roll. In 2013, Ms. Barclay was the recipient of the YWCA’s Career Woman of Achievement Award.

Skills and Qualifications:

Ms. Barclay’s qualifications include her extensive experience in human resource management, retail management and senior leadership experience at large publicly traded companies and service on other public company boards of directors.

| 8 |

|

| Proposal No. 1 – Election of Directors |

Robert Lynch President and Chief Executive Officer, Papa John’s International, Inc.

| Age: 44 | Committees: | Audit Committee

| |

| Talent and Compensation Committee |

Robert Lynch has served on the Board since March 5, 2021. Mr. Lynch has served as President and Chief Executive Officer of Papa John’s International, Inc. since August 2019. Mr. Lynch joined Papa John’s International, Inc. from Arby’s Restaurant Group, where he served as President since August 2017, and served as Brand President and Chief Marketing Officer from August 2013 to August 2017. Prior to Arby’s Restaurant Group, he served as Vice President of Marketing at Taco Bell. Mr. Lynch has more than 20 years combined experience in the QSR and consumer packaged goods industries, and also held senior roles at H.J. Heinz Company, and Procter & Gamble.

Mr. Lynch holds a bachelor’s degree in economics and political science, and a Master’s in Business Administration, from the University of Rochester.

Skills and Qualifications:

Mr. Lynch’s qualifications include his experience as a leader of a large global publicly traded company, and his extensive marketing experience, leading purpose-driven organizations and high performing teams and growing successful consumer brands.

9

Proposal No. 1 – Election of Directors

Class III Continuing Directors to Serve Until the 2022 Annual Meeting of Shareholders

Scott Baxter President & Chief Executive Officer

| Age: 56 | Committees: | None |

Scott Baxter is President and Chief Executive Officer of Kontoor and has served on the Board since the Spin-Off. Mr. Baxter was named CEO in August 2018 when VF Corporation announced its intention to separate its Jeanswear organization into an independent, publicly traded company. Mr. Baxter has more than 30 years of experience in retail, operations, marketing, merchandising, sales and manufacturing.

Prior to being named CEO of Kontoor, Mr. Baxter was Group President, Americas West, for VF. In this role, he was responsible for overseeing brands such as The North Face® and Vans®.

Mr. Baxter’s previous leadership roles at VF also included Group President, Outdoor & Action Sports, Americas and Vice President, VF Corporation & Group President, Jeanswear, Imagewear and South America. Mr. Baxter joined VF in 2007 as the President of the Licensed Sports Group. In 2008, he was named Coalition President for the Imagewear coalition, which comprised the Image and Licensed Sports Group divisions.

Prior to joining VF, Mr. Baxter served as Senior Vice President of The Home Depot Company, leading the Services Division. He also previously served as Executive Vice President of Edward Don & Company and held a series of leadership roles with Nestle and PepsiCo.

Mr. Baxter serves on the board of directors of Callaway Golf Company, a premium golf equipment and active lifestyle company. An active member of the community, Mr. Baxter is on the board of directors for the Greensboro Chamber of Commerce and the Piedmont Triad Partnership. Mr. Baxter also serves as the honorary chairman of the PGA TOUR’s 2020 and 2021 Wyndham Championship.

Mr. Baxter holds a bachelor’s degree from the University of Toledo and a Master of Business Administration degree from Northwestern University’s Kellogg Graduate School of Management.

Skills and Qualifications:

Mr. Baxter’s qualifications include his service as President and Chief Executive Officer of Kontoor, his previous leadership roles at VF and other public companies, and his service on the board of directors of another public company.

| 10 |

|

| Proposal No. 1 – Election of Directors |

Robert Shearer Chair of the Board

| Age: 69 | Committees: | Audit Committee (Chair) |

Robert Shearer has served as Chair of the Board since the Spin-Off. Mr. Shearer brings extensive management expertise to the Board, including a range of leadership experience at VF Corporation. From 2005 to 2015, Mr. Shearer served as Senior Vice President and Chief Financial Officer of VF, and from 1986 to 2005, served in various other roles of increasing responsibility at VF, including Vice President-Finance and Chief Financial Officer and Vice President-Controller. For two years, he was President of VF’s Outdoor Coalition, which was formed with the acquisition of The North Face® brand. Prior to joining VF, Mr. Shearer was a Senior Audit Manager for Ernst and Young.

Since 2018, Mr. Shearer has served on the board of directors of Yeti Holdings, Inc., a designer, marketer, retailer, and distributor of a variety of innovative, branded, premium products. Since 2008, Mr. Shearer has served on the board of directors of Church & Dwight Co, Inc., a household products manufacturer, where he currently chairs the audit committee. He previously served on the board of directors of The Fresh Market, Inc., a specialty grocery chain.

Mr. Shearer holds a B.S. in Accounting from Catawba College.

Skills and Qualifications:

Mr. Shearer’s prior role as Chief Financial Officer of VF, coupled with his 12 years of experience in public accounting, enables him to provide our Board of Directors and the Audit Committee with important insights on a range of financial and internal control matters, as well as on matters relating to capital structure, information systems, risk management, public reporting and investor relations. In addition, during his tenure at VF, his participation in expansion initiatives, including a number of acquisitions and growth in international markets, enables him to provide important insights on international operations, business combination opportunities, and strategic planning.

Class I Continuing Directors to Serve Until the 2023 Annual Meeting of Shareholders

Juliana Chugg Former EVP, Chief Brands Officer, Mattel, Inc.

| Age: 53 | Committees: | Nominating and Governance Committee (Chair)

| |

| Talent and Compensation Committee |

Juliana Chugg has served on the Board since the Spin-Off. Ms. Chugg was previously the Chief Brand Officer and Executive Vice President, at Mattel, Inc., a $6 billion worldwide leader in the design, manufacture and marketing of toys and entertainment experiences. Prior to Mattel, she spent nearly 20 years at General Mills, Inc., a global marketer and manufacturer of consumer goods, operating in a series of leadership roles where she served as the President of multiple divisions domestically and internationally. Ms. Chugg brings extensive board experience, having also served as a director of H.B. Fuller Company and Promina Group Ltd. Ms. Chugg currently serves on the board of directors of VF Corporation and served on the board of directors of Caesars Entertainment Corporation from December 2018 to July 2020.

Ms. Chugg graduated from the University of South Australia with a bachelor’s degree in Business.

Skills and Qualifications:

Ms. Chugg’s qualifications for election include her extensive experience leading major functions and divisions of large publicly traded multi-brand consumer products companies and service on other public company boards of directors.

11

Proposal No. 1 – Election of Directors

Shelley Stewart, Jr. Former Chief Procurement Officer, E.I. du Pont de Nemours & Co.

| Age: 67 | Committees: | Audit Committee

| |

| Nominating and Governance Committee |

Shelley Stewart, Jr. has served on the Board since the Spin-Off. He was previously the Chief Procurement Officer and held responsibility for real estate and facility services at E.I. du Pont de Nemours & Co. from 2012 until his retirement in 2018. Prior to joining DuPont, Mr. Stewart held leadership positions in supply chain and procurement at Tyco International, Invensys PLC, Raytheon Company and United Technologies Corporation.

Mr. Stewart currently serves on the board of Otis Worldwide where he is also on the audit committee and nominating and governance committee. He is chairman of the Billion Dollar Roundtable Inc., a top-level advocacy organization that promotes corporate supplier diversity. He is also on the Board of Trustees for Howard University as well as chair of the board of visitors for the school of business. He is also on the board of governors for the University of New Haven. He previously served on the board of directors for Cleco Corporation.

Mr. Stewart holds bachelor’s and master’s degrees in Criminal Justice from Northeastern University and received a Master of Business Administration from the University of New Haven.

Skills and Qualifications:

Mr. Stewart’s qualifications for election include his extensive experience in senior-level supply chain and operational positions with leading industrial companies and service on other public company boards of directors.

| 12 |

|

|

Executive Officers |

Kontoor’s executive officers are as follows:

| Name |

Age | Title | ||

| Scott H. Baxter |

56 | President and Chief Executive Officer | ||

| Rustin Welton |

51 | Executive Vice President and Chief Financial Officer | ||

| Thomas E. Waldron |

53 | Executive Vice President and Global Brand President—Wrangler | ||

| Christopher Waldeck |

54 | Executive Vice President and Global Brand President—Lee | ||

| Laurel Krueger |

46 | Executive Vice President, General Counsel and Corporate Secretary | ||

Certain information with respect to our executive officers, each of whom have served since the Spin-Off, is provided below. Officers are appointed to serve at the discretion of the Board. Information regarding Mr. Baxter is included in the director profiles set forth above.

Rustin Welton is Executive Vice President and Chief Financial Officer. Prior to his current role at Kontoor, Mr. Welton was VF’s Vice President and Chief Financial Officer—Americas East since January 2017. He previously served as VF’s Vice President and Chief Financial Officer for the Jeanswear Coalition, Imagewear Coalition, and Central America/South America from December 2014 until January 2017 and Chief Financial Officer—Jeanswear North and South America from 2012 to 2015. He earned an M.B.A. from Indiana University’s Kelley School of Business and a B.A. in Finance from the University of Illinois at Urbana-Champaign.

Thomas E. Waldron is Executive Vice President and Global Brand President—Wrangler. Prior to his current role at Kontoor, Mr. Waldron was VF’s Global Brand President—Wrangler since October 2018. He previously served as President—Wrangler from March 2016 until October 2018, Vice President—Mass Brands from July 2010 until March 2016, Vice President General Manager—Wrangler Male Bottoms from July 2005 until July 2010, Merchandise Manager—Wrangler Men’s from January 2003 until July 2005, National Account Executive—Walmart (Boys) from January 2000 until January 2003, National Account Executive—Walmart (Men’s) from November 1996 until January 2000 and Replenishment Manager from September 1995 until November 1996. He earned a B.S. in Economics from the University of North Carolina at Greensboro.

Christopher Waldeck is Executive Vice President and Global Brand President—Lee. Prior to his current role at Kontoor, Mr. Waldeck was VF’s Global Brand President, Lee and Rock & Republic since October 2018. He previously served as President—Lee and Rock & Republic since May 2017. Before joining VF, Mr. Waldeck was with the Adidas Group as Vice President, General Manager, Reebok USA from October 2013 until April 2017, Brand Director, Reebok Korea from May 2010 until October 2013 and Senior Director of Marketing for Equipment, Cleated Footwear from May 2004 until May 2010. He earned a B.S. in Business from Emporia State University.

Laurel Krueger is Executive Vice President, General Counsel and Corporate Secretary. Prior to her current role at Kontoor, from May 2012 to January 2019, she served in roles of increasing responsibility, and most recently as Executive Vice President, General Counsel and Corporate Secretary, at Signet Jewelers Limited, a leading global retailer of diamond jewelry. Ms. Krueger previously held a variety of legal leadership roles at publicly traded companies in retail and manufacturing, including Federal-Mogul Corporation, Tecumseh Products Company and Borders Group, Inc. Ms. Krueger earned a bachelor’s degree with high distinction from the University of Michigan-Dearborn. She earned a law degree from the University of Michigan Law School, and a Master of Business Administration with distinction from the University of Michigan-Dearborn School of Management. Ms. Krueger joined VF in 2019, prior to the Spin-Off.

13

|

Corporate Governance |

Kontoor’s business is managed under the direction of the Board. The Board regularly assesses its criteria for Board membership to identify the qualifications and skills that directors and candidates should possess. Members of the Board are kept informed of Kontoor’s business through discussions with the Chair, the President and Chief Executive Officer and other officers, by reviewing Kontoor’s annual business plan and other materials provided to them and by participating in meetings of the Board and its committees. We believe that, over time, the Board will benefit from a mix of new directors, who will bring fresh ideas and viewpoints, and longer-serving directors who will have developed deep insight into Kontoor’s business and operations. As Kontoor matures as an independent company, the Board will seek to maintain a balance of directors who have longer terms of service and directors who have joined more recently.

Corporate Governance Principles

The Board is committed to sound and effective corporate governance practices. A foundation of Kontoor’s corporate governance is the Board’s policy that a substantial majority of the members of the Board must meet the independence requirements of the NYSE. In addition, members of the Board who are also executive officers of a public company can serve on the board of directors of no more than two public companies total, and members of the Board who are not executive officers of a public company can serve on the board of directors of no more than four public companies total. These policies are included in the Board’s written corporate governance principles (the “Corporate Governance Principles”), which address a number of other important governance issues such as:

| • | composition and selection of the Board; |

| • | ineligibility to be elected as a director for a term that extends beyond the annual meeting of shareholders immediately following a person’s seventy-second birthday; |

| • | a requirement that directors offer to submit their resignation to the Board for consideration upon a substantial change in job responsibilities; |

| • | if the chair is not an independent director, election of a lead independent director; |

| • | committee structure and responsibilities; |

| • | Board consideration of shareholder proposals receiving a majority of shareholder votes; |

| • | authority of the Board to engage outside independent advisors as it deems necessary or appropriate; |

| • | majority voting for directors in uncontested elections; |

| • | succession planning for the chief executive officer and other executive officer positions; and |

| • | annual self-evaluation by the Board and each committee. |

In addition, the Board has in place formal charters stating the powers and responsibilities of each of its committees.

Director Orientation and Continuing Education

The Board views orientation and continuing education as vital tools for building an effective Board. We provide all new directors, upon joining the Board, with appropriate orientation programs, sessions or materials regarding the Board and the Company’s operations. The orientation consists of presentations by members of senior management on the Company’s financial profile, strategic plans, management organization, compliance programs and corporate policies. Directors are required to continue educating themselves with respect to topics related to the Company’s business. The Board encourages, but does not require, directors to periodically pursue or obtain appropriate programs, sessions or materials as to the responsibilities of directors of publicly-traded companies, and the Company reimburses directors for their reasonable expenses in pursuing such opportunities.

| 14 |

|

Corporate Governance

Related Person Transactions Policy

Our Related Person Transactions Policy sets forth the policies and procedures governing the review and approval or ratification by the Nominating and Governance Committee of transactions between Kontoor, on the one hand, and (i) an executive officer; (ii) a director or nominee to become director; (iii) any security holder who is known by Kontoor to own of record or beneficially more than five percent of any class of Kontoor’s voting securities (as defined in the policy) at the time of the transaction; or (iv) an immediate family member of such executive officer, director or nominee to become director, or five percent holder, on the other hand. Persons in the categories described above are collectively referred to as “related persons.” The policy applies to all related person transactions, and under the policy a “related person transaction” is any transaction in which:

| • | Kontoor was or is to be a participant; |

| • | the aggregate amount involved exceeds $120,000; and |

| • | any related person had, or will have, a direct or indirect material interest. |

No related person transaction shall be approved or ratified if such transaction is contrary to the best interests of the Company and its stakeholders. Unless different terms are specifically approved or ratified by the Nominating and Governance Committee, any approved or ratified transaction must be on terms that are no less favorable to Kontoor than would be obtained in a similar transaction with an unaffiliated third party under the same or similar circumstances. All related person transactions or series of similar transactions must be presented to the Nominating and Governance Committee for review and pre-approval or ratification.

Since the beginning of Kontoor’s last fiscal year, no financial transactions, arrangements or relationships, or any series of them, were disclosed or proposed through Kontoor’s processes for review, approval or ratification of transactions with related persons in which (i) Kontoor was or is to be a participant, (ii) the aggregate amount involved exceeded $120,000, and (iii) any related person had or will have a direct or indirect material interest. PNC Bank, N.A., which is one of three co-trustees under the Barbey Family Trust accounts (see footnote 4 to the “Security Ownership of Certain Beneficial Owners and Management—Common Stock Beneficial Ownership of Certain Beneficial Owners” table on page 55), is one of several lenders party to Kontoor’s revolving credit facility. The credit facility was entered in the ordinary course of business, was made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the lender, and did not involve more than the normal risk of collectability or present other unfavorable features.

Corporate Governance Documents

The Board’s Corporate Governance Principles and the Audit Committee, the Nominating and Governance Committee and the Talent and Compensation Committee charters are available on Kontoor’s website (www.kontoorbrands.com) and will be provided free of charge to any person upon written request directed to the Corporate Secretary of Kontoor at 400 N. Elm Street, Greensboro, North Carolina 27401.

The Board has adopted a written code of business conduct and ethics (the “Code of Conduct”), which applies to all of our employees, officers and directors. Our Code of Conduct is available on Kontoor’s website (www.kontoorbrands.com) and will be provided free of charge to any person upon written request directed to the Corporate Secretary of Kontoor at 400 N. Elm Street, Greensboro, North Carolina 27401. In addition, we intend to post on our website all disclosures that are required by law or the NYSE listing rules concerning any amendments to, or waivers from, any provision of our Code of Conduct.

The Board has concluded that Kontoor and its shareholders are best served by not having a formal policy on whether the same individual should serve as both Chief Executive Officer and Chair of the Board. The Board retains the flexibility to determine the appropriate leadership structure based on the circumstances at the time of the determination. The Board believes Kontoor has a strong governance structure in place with sufficient processes to provide for independent discussion among directors and for independent evaluation of, and communication with, many members of senior management. These processes include the lead independent director structure adopted by the Board, whereby a lead independent director will be elected from among the independent directors in the event that, in the future, the Chair of the Board is not an independent director.

15

Corporate Governance

Robert Shearer serves as Chair of the Board and Scott Baxter serves as Chief Executive Officer of Kontoor. The members of the Board possess considerable experience and unique knowledge of the challenges and opportunities Kontoor faces, and the Board believes that the most effective leadership structure for Kontoor currently is to separate the positions of Chair of the Board and Chief Executive Officer, with an independent Chair leading the Board. We believe this structure enhances the Board’s ability to exercise independent oversight of management of Kontoor during its early stages as an independent public company. During this crucial and transformative period, the duties of Chair of the Board and Chief Executive Officer are particularly demanding.

Six of Kontoor’s current directors are non-employee directors. Under the NYSE listing standards, no director qualifies as “independent” unless the Board affirmatively determines that the director has no material relationship with the company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the company). The Board has adopted categorical standards for director independence that are part of the Corporate Governance Principles and are attached to this Proxy Statement as Appendix A, to assist it in making determinations of independence. In evaluating the independence of directors, the Board considered transactions and relationships between each director and members of his or her immediate family. When considering commercial transactions that are made from time to time in the ordinary course of business between Kontoor and certain entities affiliated with non-management directors, transactions are not considered to be a material transaction that would impair the independence of the relevant non-management director if the director is an executive officer or employee of another company that does business with Kontoor in an amount which, in any single fiscal year for the past three fiscal years, is less than the greater of $1 million or 2% of such other company’s consolidated gross revenues.

The Board has determined that all of our non-employee directors are free of any material relationship with Kontoor, other than their service as directors, and are “independent” directors both under the NYSE listing standards and the categorical standards adopted by the Board. The Board determined that Mr. Shearer, Ms. Barclay, Mr. Carucci, Ms. Chugg, Mr. Lynch and Mr. Stewart are independent directors, and that Mr. Baxter is not an independent director.

The Board, in making its determination as to Ms. Chugg’s independence, considered that Ms. Chugg serves as one of the three Trustees under the Barbey Family Trust accounts (collectively, the “Trusts”). Because all decisions of the Trustees require a majority vote, and thus none of the three Trustees individually controls the decision-making of the Trustees, the Trustees are not considered to separately beneficially own the Kontoor common stock held by the Trusts. As a result, and after considering all other relevant factors related to her role as Trustee, the Board determined that Ms. Chugg’s status as Trustee of the Trusts does not give rise to a material relationship with Kontoor other than in her service as director.

Annual Board Evaluation Process

The Board and each of its committees conduct an annual evaluation to determine whether the Board is functioning effectively both at the Board and at the committee levels. The Board recognizes that a robust evaluation process is essential to Board effectiveness, which is in turn critical for ensuring that the Company has a comprehensive long-term business strategy, prudent risk management and sound governance. The Nominating and Governance Committee oversees an annual evaluation process led by the independent Chair of the Board.

Each director completes a detailed written annual evaluation of the Board and the committees on which he or she serves and the Chair of the Board conducts one-on-one interviews with each of the directors. These Board evaluations are designed to elicit feedback on the composition, dynamics, operations and structure of the Board and its committees, and to determine whether the Board and its committees are functioning effectively. The process also evaluates the relationship between management and the Board, including the level of access to management, responsiveness of management, and the effectiveness of the Board’s evaluation of management performance. The results of this Board evaluation are discussed by the full Board and changes to the Board’s and its committees’ practices are implemented as appropriate.

During 2020, the Board held 18 meetings. Under Kontoor’s Corporate Governance Principles, directors are expected to attend all meetings of the Board, all meetings of committees of which they are members and the annual meetings of shareholders. Each current member of the Board attended 100% of the total number of meetings of the Board and all committees on which he or she served during 2020.

| 16 |

|

Corporate Governance

To promote open discussion among the non-management directors, those directors meet in executive session without management present on a regular basis. At least once per year, such an executive session is held to review the report of the outside auditors, the criteria upon which the performance of the Chief Executive Officer and other senior managers is based, the performance of the Chief Executive Officer against such criteria, and the compensation of the Chief Executive Officer and other senior managers. Additional executive sessions or meetings of non-management directors may be held from time to time as needed. Executive sessions or meetings are held at each Board meeting with the Chair for a general discussion of relevant subjects. At least one meeting or executive session of non-management directors per year shall include only independent directors. During 2020, the non-management directors met in executive session without management present four times. Robert Shearer, the independent Chair of the Board, currently presides over executive sessions.

The Board has established four standing committees – the Executive Committee, the Audit Committee, the Nominating and Governance Committee and the Talent and Compensation Committee. Each of these committees is governed by a written charter approved by the Board. Each is required to perform an annual self-evaluation, and each committee may engage outside independent advisors as the committee deems appropriate. The Board has determined that each of the members of the Audit Committee, the Nominating and Governance Committee and the Talent and Compensation Committee is independent. A brief description of the responsibilities of the Audit Committee, the Nominating and Governance Committee and the Talent and Compensation Committee follows.

Audit Committee

The Audit Committee is a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee monitors and makes recommendations to the Board concerning the financial policies and procedures to be observed in the conduct of Kontoor’s affairs. Its duties include:

| • | selecting the independent registered public accounting firm for Kontoor; |

| • | reviewing the scope of the audit to be conducted by the independent registered public accounting firm; |

| • | meeting with the independent registered public accounting firm concerning the results of its audit and Kontoor’s selection and disclosure of critical accounting policies; |

| • | reviewing with management and the independent registered public accounting firm Kontoor’s annual and quarterly reports prior to filing with the SEC; |

| • | overseeing the scope and adequacy of Kontoor’s system of internal control over financial reporting; |

| • | reviewing the status of compliance with laws, regulations and internal procedures, contingent liabilities and risks that may be material to Kontoor; |

| • | reviewing and assessing, and discussing with management, Kontoor’s cybersecurity, information security and technology risks, and Kontoor’s policies and procedures to monitor, manage and mitigate those risks; |

| • | preparing a report to shareholders annually for inclusion in the proxy statement; and |

| • | serving as the principal liaison between the Board and Kontoor’s independent registered public accounting firm. |

As of the date of this Proxy Statement, the members of the Audit Committee are Messrs. Shearer (Chair), Carucci, Lynch and Stewart. The Audit Committee held nine meetings during 2020. The Board has determined that all of the members of the Committee are independent as independence for audit committee members is defined in the NYSE listing standards and the SEC regulations and that all are financially literate. The Board has further determined that Messrs. Shearer, Carucci and Lynch each qualify as an “audit committee financial expert” in accordance with the definition of such term in the SEC regulations and have accounting and related financial management expertise within the meaning of the NYSE listing standards. Messrs. Shearer, Carucci and Lynch acquired those attributes through acting as or actively overseeing a principal financial officer or principal accounting officer of a public company. Messrs. Shearer, Carucci and Lynch also have experience overseeing or assessing the performance of companies with respect to the evaluation of financial statements. No Audit Committee member currently serves on the audit committees of more than three public companies.

17

Corporate Governance

Nominating and Governance Committee

The responsibilities of the Nominating and Governance Committee include:

| • | recommending to the Board criteria for Board membership, identifying potential candidates for director and recommending candidates to the Board; |

| • | overseeing Kontoor’s significant strategies and programs, policies and practices relating to environmental, social and governance (“ESG”) issues; |

| • | making recommendations to the Board on matters of Chief Executive Officer succession in the event of an emergency or retirement; |

| • | reviewing developments in corporate governance and making recommendations to the Board for governance changes, including with respect to our Corporate Governance Principles; and |

| • | reviewing continued appropriateness of Board membership of those members who retire or change the position they held when they joined the Board. |

The Nominating and Governance Committee annually evaluates each director to determine his or her fitness and appropriateness for continued service on the Board. While diversity of experience and background are factors taken into consideration in selecting nominees, Board members are elected to represent all shareholders and not to represent any particular constituency. The Nominating and Governance Committee considers this policy to have been effective to date in identifying diverse candidates. The Nominating and Governance Committee will also consider potential candidates for director recommended by shareholders who follow the established procedures for shareholder nominations set forth in our Bylaws. As of the date of this Proxy Statement, the members of the Nominating and Governance Committee are Ms. Chugg (Chair), Ms. Barclay and Messrs. Carucci and Stewart. The Nominating and Governance Committee held four meetings during 2020.

Talent and Compensation Committee

The Talent and Compensation Committee has the authority to discharge the Board’s responsibilities relating to compensation of Kontoor’s executives and to review and make recommendations to the Board concerning compensation and benefits for key employees. The responsibilities of the Talent and Compensation Committee include:

| • | annually reviewing and approving Kontoor’s goals and objectives relevant to the compensation of the Chief Executive Officer, evaluating him in light of these goals and objectives, and setting his compensation level based on this evaluation; |

| • | annually reviewing the performance evaluations of the other Kontoor senior executive officers; |

| • | annually reviewing management’s recommendation regarding the salary of each Kontoor senior executive officer and annually making recommendations to the Board on the same; |

| • | making recommendations to the Board with respect to incentive compensation-based plans and equity-based plans; |

| • | periodically reviewing all of Kontoor’s compensation and benefit plans insofar as they relate to the senior executive officers to confirm that such plans remain equitable and competitive; |

| • | administering and interpreting Kontoor’s management incentive compensation plans, in accordance with the terms of each plan; |

| • | preparing an annual report to shareholders regarding executive compensation for inclusion in the proxy statement; |

| • | reviewing Kontoor’s Compensation Discussion and Analysis (“CD&A”), discussing the CD&A with management and recommending to the Board whether the CD&A should be included in the proxy statement; |

| • | reviewing succession planning for key senior executive officer positions of Kontoor, other than the position of Chair of the Board and/or Chief Executive Officer; |

| • | overseeing Kontoor’s inclusion and diversity efforts; |

| • | periodically reviewing the competitiveness and appropriateness of the compensation program for non-employee directors and recommending to the Board compensation to be paid to non-employee directors; and |

| • | reviewing and recommending to the Board Kontoor’s submissions to shareholders on executive compensation matters. |

The Talent and Compensation Committee has the authority to retain or obtain the advice of any compensation consultant, legal counsel or other adviser. The Committee may only select a compensation consultant, legal counsel or other adviser after taking into consideration the factors that affect the independence of such advisers as identified by the SEC and the NYSE. The

| 18 |

|

Corporate Governance

Committee has retained Frederic W. Cook & Co., Inc. (“FW Cook”) as its independent compensation consultant to assist the Talent and Compensation Committee in accomplishing its objectives. FW Cook has no relationship with Kontoor other than providing services to the Talent and Compensation Committee.

The Talent and Compensation Committee has the authority to form and delegate authority to subcommittees as it deems appropriate. The role of the Talent and Compensation Committee, the compensation consultant and management in executive compensation is discussed in further detail in the Compensation Discussion and Analysis beginning on page 24. As of the date of this Proxy Statement, the members of the Committee are Ms. Barclay (Chair), Ms. Chugg and Mr. Lynch. The Committee held six meetings during 2020.

Talent and Compensation Committee Interlocks and Insider Participation

Ms. Barclay and Ms. Chugg served as members of the Talent and Compensation Committee during fiscal 2020, and Rich Williams served on the committee until he resigned from the Board effective March 24, 2020. Mr. Lynch has served on the committee since March 5, 2021. None of the members of the Talent and Compensation Committee during fiscal 2020 (i) has ever been an officer or employee of Kontoor, (ii) had any relationship requiring disclosure by Kontoor under the rules and regulations established by the SEC, or (iii) is an executive officer of another entity at which one of Kontoor’s executive officers serves on the board of directors. None of Kontoor’s executive officers has served during 2020 as a director or a member of the compensation committee of another entity that has one or more of its executive officers serving as a member of the Board or the Talent and Compensation Committee.

Risk management is primarily the responsibility of management; however, the Board oversees management’s identification and management of risks to Kontoor. The Board uses various means to fulfill this oversight responsibility. The Board, and its committees, as appropriate, regularly receive and discuss periodic updates from the Chief Executive Officer, the Chief Financial Officer, General Counsel and other members of senior management regarding significant risks to Kontoor, including in connection with the annual review of Kontoor’s business plan and its review of budgets and strategy. These discussions include operational, strategic, legal, regulatory, financial, reputational and cybersecurity risks and the plans to address these risks.

The Board has received updates on the evolving COVID-19 pandemic from, and has discussed these updates with, our management, including with regard to protecting the health and safety of our employees, and evaluating the impact of the COVID-19 pandemic on strategy, operations, liquidity and financial matters.

Each of the Board’s standing committees assists the Board in overseeing the management of the Company’s risks within the areas delegated to that committee, and reports to the full Board as appropriate. In particular:

| • | The Audit Committee, consistent with the requirements of the NYSE and the Audit Committee charter, discusses policies to govern the process by which risk assessment and risk management are undertaken at Kontoor, including discussing with management the major financial and information technology risk exposures and the steps that have been taken to monitor and control such exposures. The Audit Committee reviews the status of compliance with laws, regulations and internal procedures, contingent liabilities and risks that may be material to Kontoor, and the scope and status of systems designed to assure Kontoor’s compliance with laws, regulations and internal procedures through receiving reports from management, legal counsel and other third parties on such matters, as well as major legislative and regulatory developments which could materially impact Kontoor’s contingent liabilities and risks. In addition, the Audit Committee has primary responsibility for overseeing risks related to cybersecurity, and receives quarterly updates from senior leadership on information security matters. |

| • | The Talent and Compensation Committee annually evaluates the risks associated with Kontoor’s compensation philosophy and programs. |

| • | The Nominating and Governance Committee oversees risks relating to the Company’s corporate governance, including ensuring the Board’s continued ability to provide independent oversight of management. |

19

Corporate Governance

Policy Against Hedging and Pledging Company Securities

Our insider trading policy prohibits our directors, executive officers and certain other designated employees from engaging in derivative securities and hedging transactions relating to our securities or short selling our securities for their own account. The prohibited transactions include trading in put or call options in which our securities are the underlying security, purchasing financial instruments, including prepaid variable forward contracts, equity swaps, collars, and exchange funds or entering into other monetization transactions that limit the ability of the director, executive officer or other designated employee to profit from an increase in the market price of our securities or provide an opportunity to profit from a decrease in the market price of our securities and similar hedging transactions.

Our insider trading policy also prohibits our directors, executive officers and certain other designated employees from holding our securities in a margin account or pledging our securities as collateral for a loan.

Our policy against hedging and pledging does not apply to all employees. We believe that applying our hedging and pledging policy to all our employees would be over inclusive given the small number of employees that receive grants of our securities.

Anyone wishing to communicate directly with one or more members of the Board or with the non-management members of the Board as a group (including the directors who preside at meetings or executive sessions of non-management directors) may contact the Chair of the Nominating and Governance Committee, c/o Corporate Secretary of Kontoor at 400 N. Elm Street, Greensboro, North Carolina 27401, or call the Kontoor Ethics Helpline at 1-844-476-9158 or send an email message to corp.gov@kontoorbrands.com. The Corporate Secretary forwards all such communications, other than solicitations and frivolous communications, to the Chair of the Nominating and Governance Committee.

Corporate Sustainability and Responsibility

Our sustainability approach is aligned with Kontoor’s focus on innovation, design and sustainable performance. It underscores our commitment to our purpose: to inspire people to live with passion and confidence. Through our three strategic pillars—Planet, Product and People – we emphasize protecting the environment, sourcing products and materials from companies that share our values and operating with the highest standards of ethics and transparency.

We are pleased to have published our inaugural Sustainability Report in September 2020. We also announced our first global sustainability goals to measure and manage our progress. Additionally, we have aligned our goals with the relevant United Nations Sustainable Development Goals. Our Global Sustainable Business Team leads our enterprise-wide sustainability efforts, working closely with our stakeholder groups globally to ensure progress toward our goals.

Sustainability Governance

The Board is responsible for promoting the exercise of responsible corporate citizenship and monitoring adherence to our standards. The Nominating and Governance Committee reviews and evaluates our strategies, programs, policies and practices relating to ESG issues and impacts to support the sustainable and responsible growth of our business. We articulate our commitments to corporate sustainability and responsibility in our Code of Conduct.

The Kontoor Brands Sustainability Council champions our company-wide commitment to sustainability performance and transparency. The Council, which consists of members from our Executive Leadership Team, our Global Sustainability Business Team and select working group leaders, meets bi-annually. The Council promotes and guides progress toward Kontoor Brands’ Global Sustainability Goals and fosters our culture of sustainability.

Our Enterprise Risk Management Council is organized to identify, evaluate and manage risk topics and issues, in alignment with our business priorities. The Council meets regularly and provides leadership on strategy, financial, operational, compliance and reputational risk.

| 20 |

|

Corporate Governance

Materiality Assessment and Goals

Kontoor’s Global Sustainability Business Team discussed the landscape of salient material issues and the best organization of the issues into understandable groupings to present to stakeholders.

External subject matter experts analyzed over 300 contextually relevant articles on material issues and sustainability governance to inform the identification and organization of the issues. Additionally, specific reporting frameworks such as the Global Reporting Initiative (GRI), THESIS (The Sustainability Insight System) Index and the Sustainability Accounting Standards Board (SASB) were reviewed for relevant material issues.

Kontoor’s Global Sustainability Business Team reviewed GRI’s stated objectives, guidance and requirements while also evaluating dozens of material issue presentations by our industry peers, as well as those outside our industry.

Based on the results, we set six ESG goals aligned with the United Nations Sustainable Development Goals (SDGs). We measure and manage our progress through goals and measurable targets.

| Topic |

Goal | |

| Energy |

Power 100 percent of owned and operated facilities with renewable energy by 2025 | |

| Climate |

Establish a science-based target by 2022 | |

| Water |

Save 10 billion liters of water by 2025 | |

| Materials |

Source 100 percent sustainable raw materials, including Forest-Derived and Animal-Derived Materials by 2023, Cotton by 2025 and Synthetics by 2030 | |

| Chemistry |

Use 100 percent preferred chemistry by 2023 | |

| Worker Well-Being |

Work only with factories that support a worker well-being or community development program by 2025 | |

Inclusion and Diversity

Inclusion and Diversity have been at the heart of the Company and ingrained in our values since Kontoor was created. In 2020, we introduced our Inclusion and Diversity strategy and multiyear objectives, which are overseen by the Talent and Compensation Committee. This will provide transparency with respect to our journey, establish measurable and visible objectives for the changes we seek to achieve, and put into motion detailed plans to get us where we need to be.

The Nominating and Governance Committee considers diversity as one of many factors in identifying nominees for director, including personal characteristics such as race and gender, as well as diversity in the experience and skills that contribute to the Board’s performance of its responsibilities in the oversight of a complex and highly-competitive global business. The Nominating and Governance Committee does not assign specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees.

21

|

Director Compensation |

The primary components of compensation for our non-employee directors are a cash retainer, equity-based grant of restricted stock units (“RSUs”) under Kontoor’s 2019 Stock Compensation Plan and Committee Chair fees. The Board sets director compensation annually based on an analysis of non-employee director compensation practices at Kontoor peers and peer company information provided by FW Cook, the independent compensation consultant to the Talent and Compensation Committee. The following describes our fiscal 2020 non-employee director compensation:

| Compensation Element | Director Compensation Program | |

| Annual Cash Retainer |

$85,000, paid quarterly arrears in cash | |

| Annual Equity Retainer |

RSUs equaling $160,0001 | |

| Committee Fees |

None | |

| Committee Chair Fee2 |

$20,000 | |

| Non-Executive Director Chair Retainer |

$175,000 | |

| Meeting Fee for Board Meetings in Excess of Ten Meetings During the Year |

$1,500 per meeting | |

| Stock Ownership Guidelines |

Stock ownership with a fair market value equal to five times the annual cash retainer3 | |

| 1 | RSUs are fully vested and non-forfeitable at grant and will be settled in shares of Kontoor common stock one year after the date of grant. RSU retainer grants will be pro-rated in the year of a director’s initial election to the Board and will vest in the same manner as other awards subject to the annual equity grant. |

| 2 | Chairs of the Audit, Talent and Compensation and Nominating and Governance Committees are eligible to receive committee chair fees. |

| 3 | Messrs. Shearer and Carucci and Ms. Chugg exceed the target for director stock ownership. Non-employee directors must retain 100% of the net shares resulting from the vesting of RSUs until the guideline is met. |

In response to the impact of the COVID-19 pandemic, the non-employee directors: (i) elected to forego cash retainer and committee chair fees for the second quarter of fiscal 2020, excluding the non-executive director chair fee and (ii) waived their meeting fee for Board meetings in excess of ten meetings during the year for fiscal 2020.

Mr. Baxter, the only director who is an employee of Kontoor, does not receive any compensation in addition to his regular compensation for service on the Board and attendance at meetings of the Board or any of its committees.